If you’re selling on Shopify, you’ve likely been introduced to Shopify Payments (“ShopPay”). The portal has emerged as a popular payment gateway choice for ecommerce businesses, providing a streamlined solution for transaction processing and financial management. Several clients have come to us asking us to help get the payment process setup on their site because they encountered difficulties along the way. Through our experience getting Shop Pay setup, we learned a few things Shopify store owners will find helpful.

- What are Shopify Payments?

- Problems companies face

- How to setup Shopify Payments

- Avoid common mistakes

- The future of Shopify Payments and Meta

What are Shopify Payments?

Originally launched in 2017, Shop Pay has gained traction over the last 2 years as a valuable tool for Shopify store owners and ecommerce customers. ShopPay speeds up the checkout process for customers, getting them from ‘Checkout’ to “Order Confirmed” faster. Customers only have to type in payment information once. For every checkout, the tool automatically recognizes your profile when visiting a participating online store. Shopify Payments offers businesses the ability to process payments directly on their Shopify stores by managing payment information through Stripe. It provides a comprehensive suite of features, including:

- Seamless integration with the Shopify platform

- Simplified payment processing

- Unified reporting.

Shopify Payments facilitates business owners’ ability to take multiple payment types, traces sales activity, and helps manage finances.

Shopify store owners can add this simple button to their checkout pages and customers will be able to:

- Save credit card information to create faster checkout experiences

- Select local delivery/pickup selections where applicable

- Receive customized product and store recommendations based on purchase behavior

Keep Reading: Types of Paid Advertising to Boost Your Ecommerce Business

Fee Structure

Shop Pay fee structure is standard to other payment methods. Shop Pay will collect a 2.6% transaction fee + 30¢ per online order.

Shop Pay also offers an installment feature that allows customers to pay across 12 months for purchases ranging from $50-$3,000. The merchant is responsible for a 5%-6% transaction fee on each transaction.

Setting up Shopify Payments

Navigate to your Shopify Payment Profile

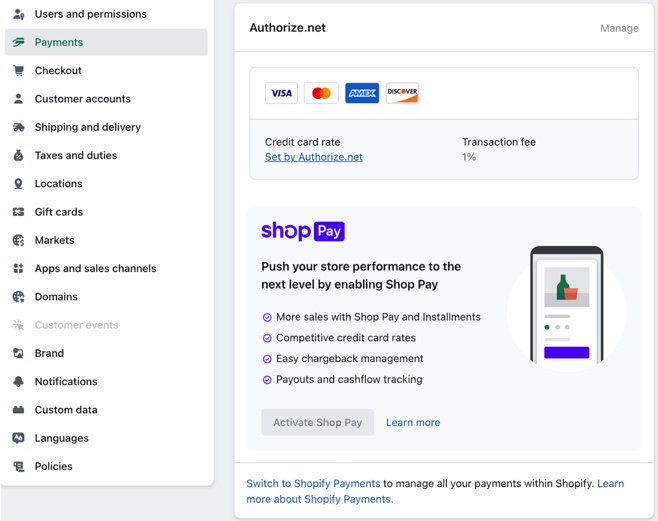

Sign into your Shopify account, go to settings and then “Payments”. In the Shopify Payments section, click Manage. In the Shop Pay section, check Shop Pay. Click Save.

Verify eligibility

Ensure that your business is based in a supported country and complies with Shopify Payments’ terms and conditions. Eligibility may vary based on the region.

Complete the application

Access your Shopify admin dashboard and navigate to Settings > Payment Providers > Shopify Payments. Provide the necessary information, including business details, banking information, and legal documentation.

Challenges and Cautions

While Shopify Payments offers convenience, it may not be uniformly beneficial to all types of ecommerce businesses. Some common challenges include:

Limited availability

Shopify Payments may not be available in all countries or regions, which can pose a challenge for international businesses. Research alternative payment gateways compatible with Shopify to ensure uninterrupted operations.

Payment processing errors

Businesses have reported issues such as declined transactions or failed payment captures. Understanding Shopify’s error codes and messages can help troubleshoot and resolve these problems promptly.

Account holds and payout delays

Account holds, due to increased chargebacks or suspicious activity, can result in delays in receiving payouts. Complying with Shopify’s terms and maintaining transparency can minimize the risk of account holds.

Selling Directly on Meta Platforms

What’s more, we will look into how social media websites, such as Meta, plan to force businesses intending to use Meta as a trading marketplace to offer direct purchase options for its users. For businesses already using Shopify, this means making the switch to Shopify Payments or Shop Pay extensions to third-party payment providers.

Beginning April 24, 2024, Meta has mandated that businesses wishing to sell on Facebook and Instagram must enable Shops with checkout. Shops that direct customers to an external ecommerce site for purchases will no longer be accessible. To comply, business owners can leverage Shopify Payments or attach Shop Pay to a third-party payment provider, allowing them to sell directly on Meta platforms.

Furthermore, with Meta’s new regulations, utilizing Shopify Payments or integrating Shop Pay with a third-party payment provider can help businesses sell directly on popular social media platforms. Stay informed, adapt to changes, and explore available resources to optimize your ecommerce operations.

LimeLight Marketing is focused on “Squeezing the Day” for our clients and partners! We are committed to making marketing simpler to comprehend, more efficient, and ultimately more productive. Businesses can confidently pursue their larger ambitions with the help of a reliable agency, such as LimeLight. We want to make it easier for businesses to manage their marketing efforts, such as transitioning to Shopify Payments or other payment methods with third-party payment providers, by simplifying the process. Get in touch with our Paid Media team today.